System

Abacus Enterprise Workflow

Personal Tax

PRT

Authorised Investment Fund

Corporation Tax

Group Module

Investment Trust

Life

Hotline

Pack development

P11D

Partnership Tax

Partnership Gains

Tracker

Administrator

Irish Corporation Tax

Abacus+

Hong Kong Profits Tax

Abacus Enterprise Workflow

Abacus+ v2

PCS Client Manager

VAT

System Lite

Corporation Tax Lite

Corresponding Period Group Relief Allocation |

See Also

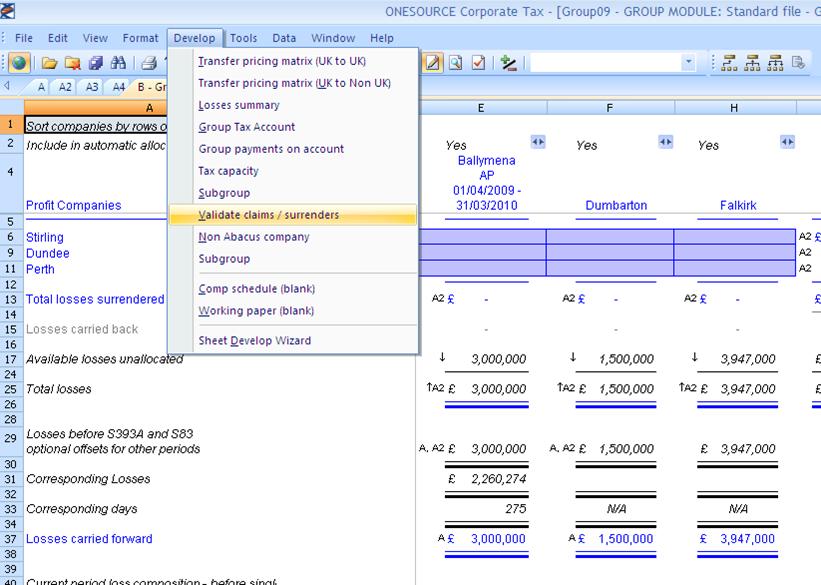

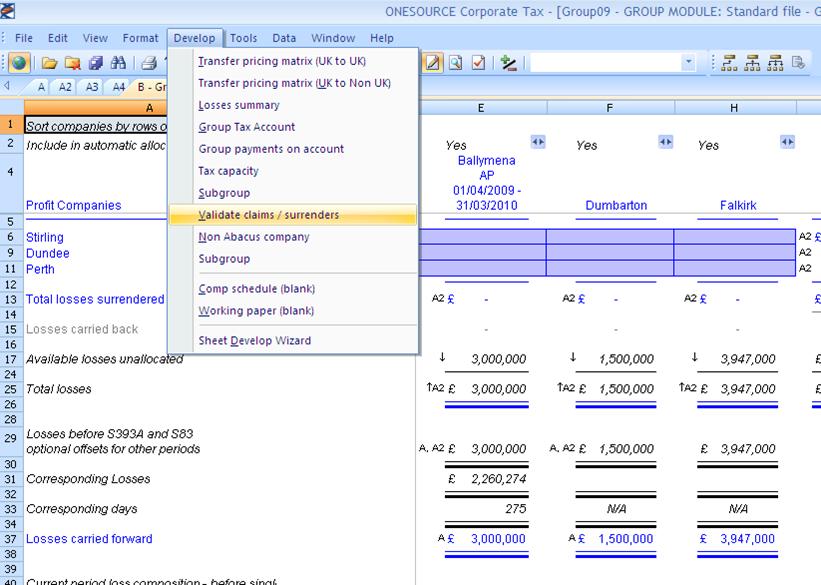

A. Develop the Validate Claims / Surrender Sheet

1. Develop the sheet from B Group relief matrix > Validate claims / surrenders.

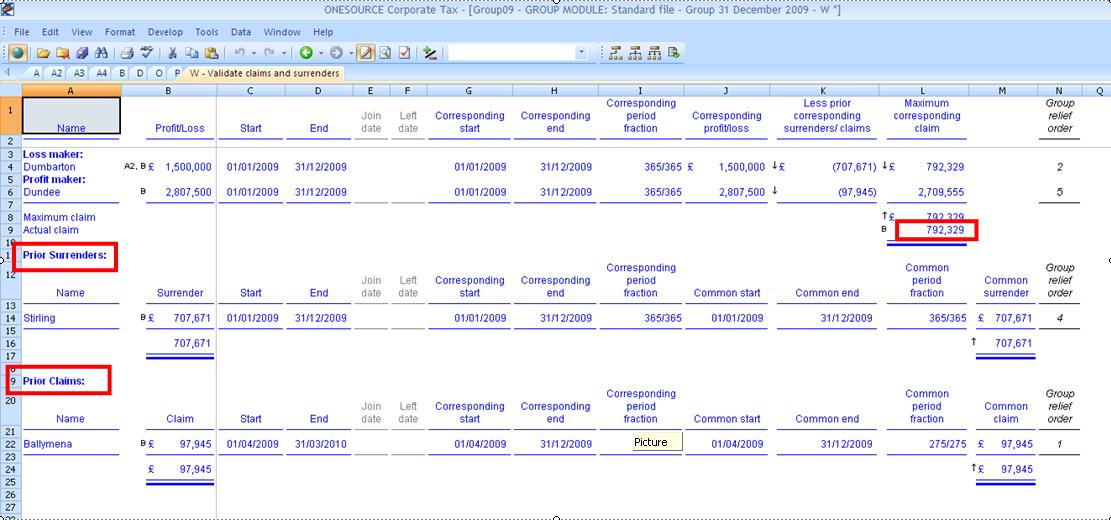

2. The validate claims and surrenders sheet will display and validate the actual claim made between the selected profit maker and loss maker on the B sheet, see Step D below.

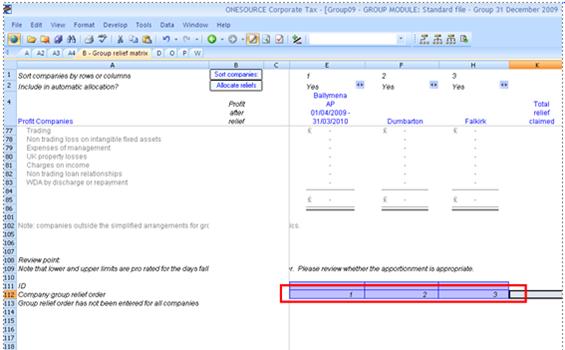

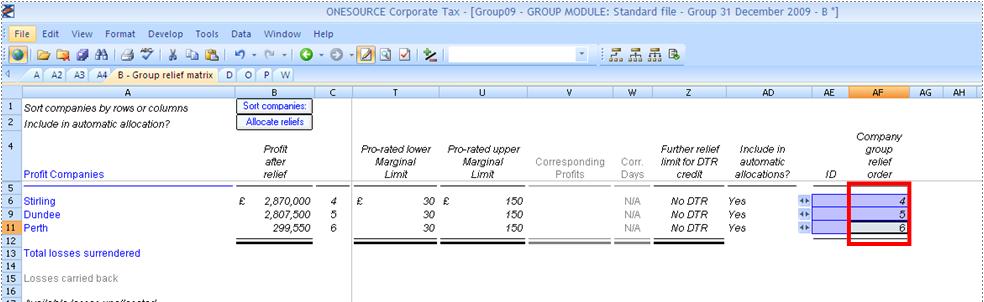

B. Add Group Relief Orders

1. You are required to enter the order in which the allocation will run for both the profit makers and loss makers on the B sheet. This is crucial because the corresponding period automatic allocation will use the order that you give when allocating group relief.

2. The order for the loss makers should be entered at the bottom of the B sheet and the order for the profit makers should be entered at the far right of the B sheet.

Hints and Tips:

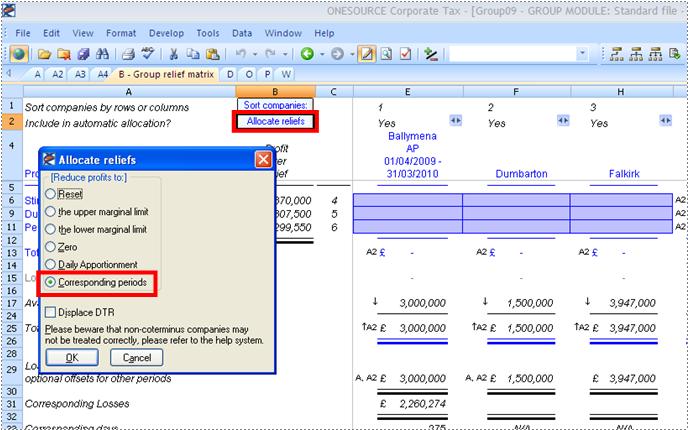

C. Run Corresponding Period Automatic Group Relief Allocation

1. Once order numbers have been entered, click on the allocate reliefs button on the B sheet, select Corresponding periods and click OK. This will allocate group relief on the matrix using the order you provided in Step B.

Hints and Tips:

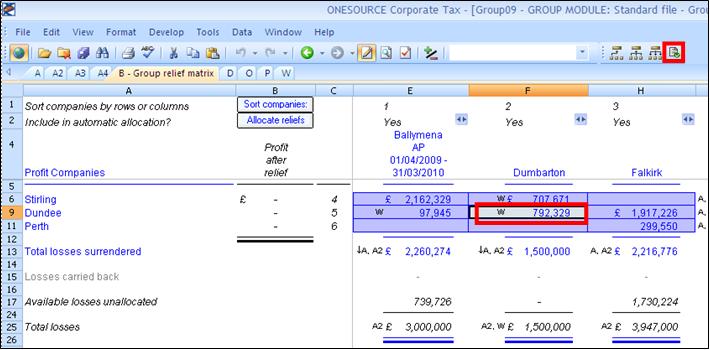

D. Validating a Claim

1. Any group relief claim between a pair of companies on the group relief matrix can be validated by selecting that claim and clicking on the Validate claims button on the group module toolbar.

2. The validate claims and surrender sheet developed in Step A displays the actual claim made between the selected profit and loss maker. All prior claims by the profit maker and prior surrenders by the loss maker are shown proving the validity of the claim. The sheet shows an error when an invalid claim is entered on the B sheet.